АО "UNIFIED PENSION SAVINGS TRUST"

The UAPF provides services to the population through:

- Direct Service System — servicing at the Fund’s offices, on-site service (mobile agent, mobile office);

- Self-Service System – electronic services on the Fund’s website, egov, mobile application, self-service terminals and information kiosks;

- remote consulting system – remote service channels (Call-center, Online Consultant on the Fund’s website, chat bots in messengers, social networks pages).

The total volume of operations in 2018 amounted to 20,9 mln:

Direct Service System

Self-Service System

543,1K requests from contributors (recipients) were received through the remote consulting system in the reporting period, which is 34% higher than numbers of the last year (405,8K requests).

АО "UNIFIED PENSION SAVINGS TRUST"

In the reporting period, there was a general decrease in the number of operations provided through direct servicing by 1.0 mln operations or 16% as compared to 2017, while growth in the number of operations provided through on-site servicing amounted to 18%.

Decrease in the number of operations is observed for all types of services provided, except for issuance of agreements in new wording, certificates of accounts held and accepted applications for joining CPPC pension agreements (2%). So, the largest decrease in the number of operations in percentage terms is observed for the following operations:

- issuance of certificates to military servicemen (33%) in connection with the bulk of the military servicemen who applied in the period from 2016 to 2017;

- acceptance of applications for changing details (26%);

- execution of agreements to determine or change the way of reporting (21%);

- issuance of Pension Statements from individual pension accounts (19%);

- acceptance of applications to open individual pension accounts (16%) due to the electronic services development;

- acceptance of applications for payment (17%) in connection with increase in the retirement age of women and introduction of a composite service (payment through PSC).

The average load on employees providing services at the Fund’s offices in the reporting period amounted to 23 operations per day, on-site employees – 18

The main direct service channel is the offices that are part of the structure of 18 branches. In order to effectively organize the activities of regional representative offices in 2018, due to low attendance and workload for employees, 6 branches of operating departments and 10 service centers were closed in 9 branches of the Fund. Additionally, since January 1, 2019, 97 service centers were closed in 16 branches with the simultaneous opening of 97 remote workplaces in the same settlements.

Another direct service channel in UAPF is the Fund’s on-site servicing, which is represented by mobile offices and “mobile agents”.

In April 2018, 3 mobile offices were commissioned (in Almaty, Atyrau and Kostanai regional branches). Mobile offices are technically equipped vehicles that are designed to serve contributors (recipients) living in remote (small) settlements.

On-site servicing by “mobile agents” ensures provision of services by the Fund to low-mobility groups of people (persons with disabilities, persons at restricted access and guarded facilities) and at the place of work of contributors (recipients) as an additional service in conducting outreach (presentations). The number of operations performed by “mobile agents” in the reporting period amounted to 201,3K operations within 8,7K on-site visits. As compared to 2017 (189,5K operations, 7,1K on-site visits), the number of operations increased by 6% while the number of visits increased by 22% in the reporting period.

Out of the total number of operations within the framework of field services, 27,8K services were provided to 10,3K contributors and recipients with disabilities, which is 28% and 24% less than numbers of the last year (38,7K operations and 13,5K serviced contributors and recipients) respectively. Decrease in indicators on servicing socially vulnerable segments of the population is due to the servicing of the bulk of this category in the period from 2016 to 2017.

Within the framework of development of transfer-agent servicing, the Fund signed a Memorandum on Cooperation with Kazpost JSC in the reporting period. The purpose of signing the Memorandum is the cooperation of the Fund with the national postal operator with a network of branches and divisions throughout the Republic of Kazakhstan to ensure expansion of the population coverage with fully funded pension system, increase accessibility by outsourcing the services of the Fund to Kazpost JSC to serve the population in settlements with low workload, remote (small) settlements.

АО "UNIFIED PENSION SAVINGS TRUST"

The UAPF self-service system includes pension services, which anyone can get on their own without assistance of an UAPF employee at a convenient time and place through the Internet and mobile communication.

In 2018, the entire range of pension services was implemented in electronic format with a few exceptions, from the opening of IPAs to submission of applications for payments. The Fund developed, finalized and implemented the following electronic services in the reporting period:

- issuing a certificate of IPA availability, a duplicate of application for IPA opening or a pension coverage agreement in the personal account of the contributor (recipient) on the website and through self-service terminals – 11,6K contributors used it from the moment of its implementation (February 2018);

- conclusion of agreement at the expense of voluntary pension contributions in own favor on the UAPF website — since the launch of the service (June 2018), 7,4K agreements have been concluded.

Only services that require special verification of paper documents remained undigitalized – opening of tripartite agreements (at the expense of CPPC and VPC in favor of a third party), processing payments in connection with getting permanent residence abroad and payments in connection with the death of the contributor (recipient). Also, the service of transferring pension savings to insurance organizations under a pension annuity agreement remained in the automation phase.

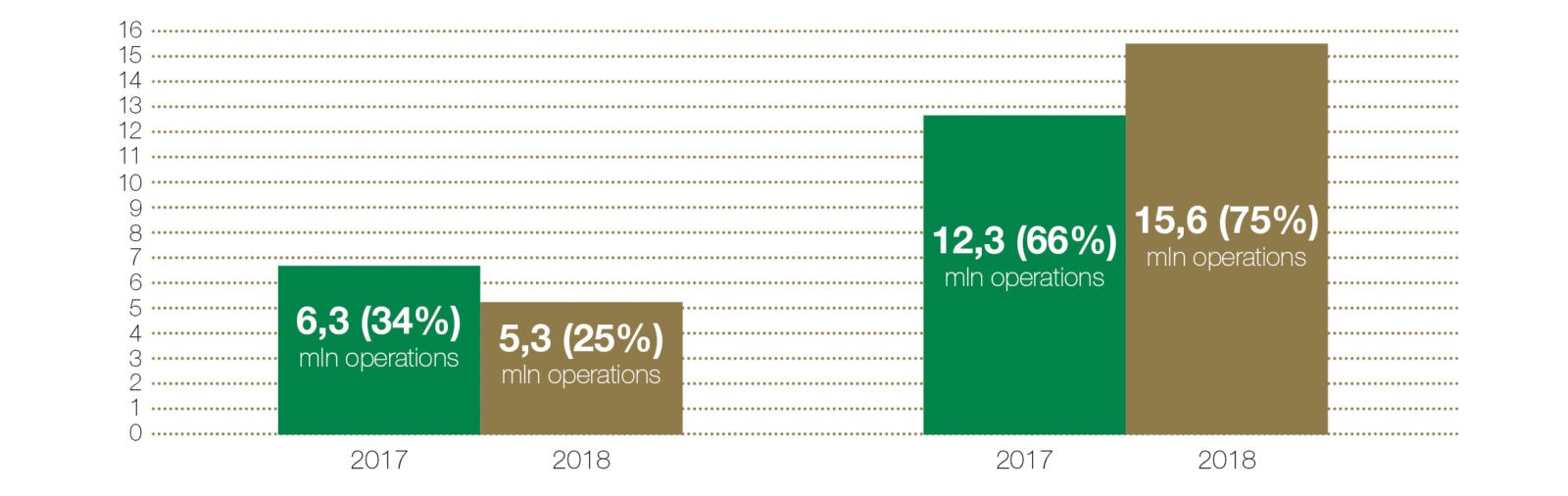

Dynamics of provision of electronic services in contrast to the services provided in the offices of the Fund demonstrates a significant increase in the number of users of the Fund’s pension services through electronic channels. In total, in 2018, 15,6 mln services were provided through electronic channels to 2,9 mln contributors (recipients), which is 27% higher than in 2017. The share of UAPF pension services through electronic communication channels of the total volume of transactions reached 75% at the end of 2018. As compared to 2017, increase is noted in all types of electronic services:

- issuance of Pension Statements from IPAs – by 24% (15,258.4K services);

- making amendments or supplements to the details – by 124 times (146,7K services);

- opening of the IPAs – by 490 times (121,1K services);

- changing the way of reporting – by 86 times (43,6K services);

- filing an application for pension payments – by 186 times (8,9K services);

- issuance of duplicate agreements/applications for the opening of IPAs – 11,6K services (implemented in February 2018).

Electronic pension services are available on the UAPF website, mobile application, the E-Government Portal, through self-service terminals and information kiosks located at the Fund’s offices. Additionally, clients can also receive information and consulting services through information kiosks and without assistance of UAPF employees, such as:

- view training videos on the use of pension services (“Internet Services”, “Internet Pension Statement”, “Mobile Application”);

- use the “Pension Calculator” service to calculate estimated pension payment;

- send Pension Statement from the IPA to a personal e-mail.

The most convenient channel for receiving pension services for contributors is the Fund’s mobile application (35% of all electronic services). The number of UAPF mobile application downloads for the reporting period amounted to 756K downloads (16% of the 2017 indicator – 650K downloads). The number of downloads for the entire period since the implementation (May 2014) of the application amounted to 1,9 mln downloads.

The most popular service is issuance of electronic Pension Statement from IPAs. 15,3 mln electronic Pension Statements were generated (or 92% of all issued Pension Statements, 73% of all services provided) at the request of 2,6 mln contributors (recipients) in the reporting period. As of January 1, 2019, the number of IPAs with electronic methods of reporting (receiving Pension Statement from IPAs) amounted to 6,1 mln (27% from the beginning of the year or 1,3 mln IPAs):

- online – 5,2 mln IPAs (31% or 1,2 mln by 2017);

- via e-mail – 879K IPAs (9% or 72K by 2017).

Switch of contributors and recipients to electronic methods of reporting allows to reduce the expenses of UAPF for annual mailing of envelopes with Pension Statements to contributors and recipients who have chosen the method of reporting by traditional mailing. Thus, at the end of 2017, reporting was carried out by mail, during which 1,3 mln envelopes with Pension Statements from the IPAs were sent to contributors (recipients) in the reporting period. For comparison, 1,7 mln Pension Statements were sent within the framework of reporting at the end of 2016.

АО "UNIFIED PENSION SAVINGS TRUST"

The Fund received 543,1K addresses from citizens through feedback channels (34% of the indicator for 2017) in the reporting period:

- 65% of addresses were received through the Call center;

- 23% – through the online consultant service on the Fund’s website and the WhatsApp messenger;

- 1% – through other channels (feedback service, blog of the Chairman of the Management Board, social networks pages, administrative office, customer feedback book).

The Fund has promptly provided responds to the received addresses, all complaints and claims received have been processed (appropriate measures have been taken for substantiated complaints), proposals of contributors (recipients) have been considered.

Within the framework of development of remote consulting system, the Fund carried out the following activities in the reporting period:

- Telegram bot was launched in May, which allows to receive services (information on the status of the IPAs, sending Pension Statement to e-mail, news, etc.) through a messenger;

- a new remote channel was introduced in July — a chat bot in the WhatsApp messenger, which allows to receive consultations on pension issues for people located both in Kazakhstan and abroad. From the moment of implementation until the end of 2018, 40,4K addresses were received, which is 7% of the total number of received addresses.

АО "UNIFIED PENSION SAVINGS TRUST"

During the year, the Fund continuously formed outreach flows in the media. In 2018, 110 press releases were distributed in the state and Russian languages. Over 50 responses to journalist inquiries were prepared within the established time limit.

The total amount of outreach materials with the mention of the UAPF published in the media in 2018 amounted to 32,1K publications/materials, which is 1.5 times higher than the volumes of 2017 (21,5K publications/materials), of which:

- 89% publications/materials were published in regional media (in 2017 – 66%);

- 11% — in the republican media, (in 2017 – 33%);

According to information directly provided to the UAPF, 25,6K publications/materials (or 80% of the total volume of publications) were published through various media channels, which is 1.7 times higher than in 2017 (15K publications). Allocation of publications by distribution channels is as follows:

- 3% electronic media and news agencies – 21,8K publications (74% of the 2017 indicator);

- 4% print media – 2,4K publications/materials (20% of the 2017 indicator);

- 1% television – 783 publications/materials (70% of the 2017 indicator);

- 2% radio – 551 publications/materials (138 times more than the 2017 indicator).

The UAPF corporate website is also one of the key communication channels, the number of views for the 12 months of 2018 amounted to 29,9 mln views, which is 1.4 times higher than the 2017 indicator (20,8 mln). Additionally, the Fund’s official social networks pages (with a total audience of subscribers of 31,6K people) posted 252 publications/materials (infographics, multimedia and news materials), presented answers and comments to 2,3K user requests in the reporting period.

An important role was assigned to press events in 2018. 6 briefings and 2 press conferences were held on current issues with the participation of the Fund’s management. Based on the results of 8 events, 928 information publications/materials were published (for comparison, 9 events were held in 2017, which resulted in 1,7K news publications/materials).

The Round Table dedicated to the 20th anniversary of the fully funded pension system was the key event held in Almaty and simultaneously in all branches of the Fund. Founders of fully funded pension system, experts, public figures, representatives of the National Bank and the Ministry of Labor and Social Security and journalists were invited to this event. The topics were dedicated to the history and ways of developing the system. The main conclusions made at the event and reflected in the media: “fully funded pension system of the Republic of Kazakhstan is successful and on the right track”. Over 70 news publications/materials were published following the results of the event.

The Fund carried out outreach activities with contributors (recipients) and through direct interaction. “Open Doors Days” were held on a quarterly basis, according to the results of which the total number of visitors amounted to 21K people (as compared to 13,8K in 2017), the number of media publications amounted to 5,5K (as compared to 2,5K in 2017).

Within the framework of roadshows at enterprises and organizations in the reporting period, the Fund’s branches conducted 25,1K presentations for a total number of 788,1K people. The 2018 indicators in terms of the number of held presentations and the number of those present exceed the 2017 indicators by 39% and 42%, respectively.

Statement of the Chairman

In 2018, Kazakhstan’s fully-funded pension system celebrated its 20th anniversary. A fully-funded pension system can only be considered as mature 40 years after its inception, when at least one generation has completed a full career cycle of membership in the system, which requires making regular contributions.